Spontaneous holiday?

Friends talking about going on a holiday? Transfer funds from your powerup and book instantly with your wizitcard.

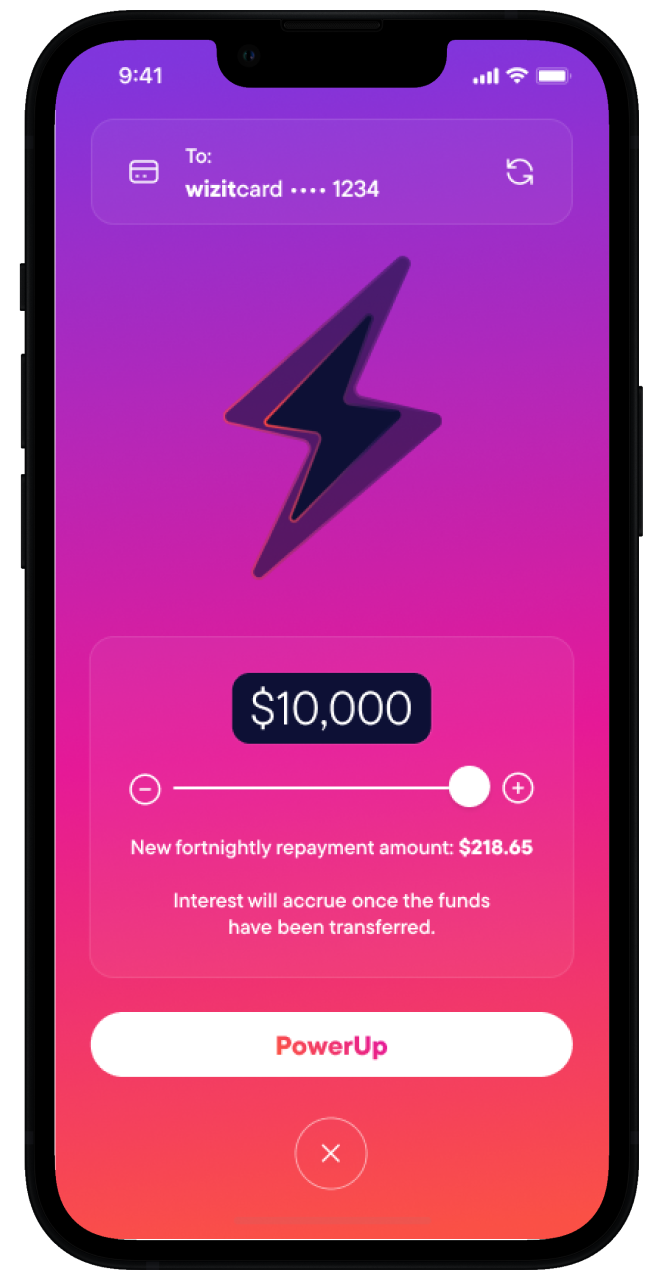

Get up to $30,000

Rates starting from 19.9% p.a

Access money fast

Friends talking about going on a holiday? Transfer funds from your powerup and book instantly with your wizitcard.

Need to access extra funds to take advantage of a last minute sale? Use your powerup to transfer to your wizitcard and checkout instantly.

We get it. Sometimes unexpected things happen and you could use a bit of extra help. Powerup is there when you need it, with no fees or interest when you don’t.

Instantly supercharge the amount you can spend on your wizitcard.

Transfer funds to you bank account and spend how you like.

We understand that everyone has a different history when it comes to managing their finances. That’s why we offer a range of rates and limits to cater for different situations.

Draw down funds anytime and only pay for what you draw down.

*A Late Fee of $1.00 is payable per day that the account is overdue. This amount is capped at $100 per rolling 12 month period and subject to 10 day grace period. A $0.55 Dishonour Fee is also payable in the event that a direct debit is not honoured.

Unlike traditional lenders, we consider more than just your credit history.

We offer a range of inclusive rates and limits to cater for different situations.

Download the app to access your account and apply for

our new payment options.

I'm 18 years of age or over

I'm a permanent Australian resident

Additional eligibility criteria applies. Refer to the TMD for more information.

Copy of Driver Licence, Passport or Medicare card

Regular source of income